The concept of microfinance is not new. The form of microfinance services we see today is largely derived from the community-based mutual credit transactions that existed centuries ago and that were based purely on trust and non-collateral borrowings and repayments. The first microfinance service in Papua New Guinea (PNG) was introduced by the Asian Development Bank (ADB) in 2002 under the Microfinance and Employment Project. Today, microfinance services in PNG are supplied through the state-owned National Development Bank, five licensed microbanks, 21 savings and loans societies (SLS) and around 70 small community-based non-government organisations.

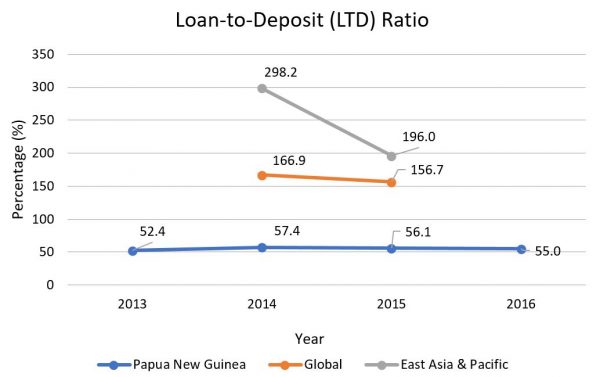

While these financial institutions have successfully reached out to more than 43,000 microcredit borrowers and 250,000 depositors in PNG over the years, the microfinance industry has been facing the problem of disproportionately low demand for borrowings in comparison to savings deposits since inception. This problem was first highlighted in the Microfinance and Employment Project’s completion report prepared by ADB in 2010. It is also reflected in the data prepared by Microfinance Information Exchange (MIX), which shows that the loan-to-deposit (LTD) ratio of PNG’s microfinance industry ranged from 52-58% between 2013 and 2018. This implies that for every kina deposited in a microfinance institution (MFI) in PNG, only 55 toea are lent out as a loan to the public.

The LTD ratio is usually used as a measure to evaluate the liquidity and financing structure of a financial institution, and to determine whether it is capable of self-funding or requires external financing. While there is no general rule of thumb for where the optimal LTD ratio lies, the MFIs in PNG have been experiencing a much lower LTD ratio than the global and regional average standard over the years. The above graph shows that the East-Asia and Pacific region, which comprises 136 MFIs in 14 countries (including PNG), has a track record of issuing loans at least two times the value of deposits in 2014 and 2015. More importantly, PNG remains the only country in the region with a LTD ratio of less than one. This implies that there may be excessive liquidity in the country’s MFIs that is not fully utilised for loan purposes.

Operational self-sufficiency (OSS) is a measure used to evaluate MFI sustainability. It assesses the ability of a financial institution to cover its operational and financial expenses with its revenues. The data in the second figure shows that the country’s MFIs on average just barely achieved self-sufficiency, at 101.6% and 99.4% in 2015 and 2016 respectively. While all five savings and loan societies (SLS) in the survey sample recorded more than 100% self-sufficiency, the micro-banks on average have not been able to. This implies that on average the revenues received by the micro-banks are not large enough to cover their expenses.

This result is not surprising given that the SLS only issue loan products exclusively to their members and have few branches. The micro-banks on the other hand, experience high operational costs associated with providing services to the general population by setting up branches and establishing financial agents in the most rural and remote regions of the country. However, the situation faced by the micro-banks could be improved with an increase in the demand of loans from the population. As most of the unutilised funds from the surplus of deposits over loans are used to invest in government and treasury bills, with returns ranging from 4.7% (182-day T-bill) to 8.0% (364 day T-bill), the MFIs could have easily earned much more by issuing more loans at a higher interest rate.

The ongoing low LTD rate in the MFIs certainly decreases the effectiveness of what microfinance can do to help the poor. While there are many different services covered under the umbrella term of microfinance, such as micro-insurance and micro-leasing, microcredit undoubtedly forms the core of microfinance as it is the only channel whereby people living in poverty can gain access to extra money (credit) for personal use and wealth creation. Lower demand for microcredit among rural and low-income households leads to lower wealth creation. This prevailing problem is not only impeding efforts to reduce poverty effectively, it is also hampering the government’s initiatives to promote growth in local business ownership and expand the country’s tax base.

It is important to note that the low LTD ratio is a sector-wide problem and does not only affect the microfinance industry. In fact, PNG’s banking and financial sector has the lowest LTD ratio of any country in the Pacific. The PNG government needs to develop a more comprehensive policy to address the lack of lending in the country. Financial incentives such as an interest rate cap or the use of less stringent collateral requirements may not be sufficient or may even be counterproductive. Rather, the government needs to improve the business environment in PNG so that the general population is able to develop bankable projects. Increased demand for credit and greater lending will then follow.

Helo from Vanuatu. There are also many non monetary factors (similar in Vanuatu) that can influence demand for credit: a) The low level of financial literacy tend to be popular at micro level target market which could create “perceived fear”amongst potential clients from borrowing b): Issues with access to markets where borrowers can sell their produce promptly whenever harvests are due and buyers are available c) infrastructure issues to get to funding locations , d) heavy logistic processes or procedures (paper work) for a basic Finance Model, d) Lack of ongoing consistent support given to borrowers which otherwise could detect early signs of credit problems, etc. Also, strong influence of pacific culture in mixing business with our traditional style of managing finance complicate matters at times. Culture factor can also extends to shying away from informing financial institutions when we have loan problems or switched to “silent mode” until last minute pressure from MFI. Anywhere in the Pacific, what we need is building “Financial Clinics” (not just health clinics) in rural communities in proximity to borrowers locations to provide instant reliable management advisory support to those struggling, hence, reducing default rates and empowering borrowers. Those MFI also need to be innovative to create basic products that best align with client financial circumstances and not over lend. Financial staff must educate themselves on national economic trends of emerging new markets so they can create new lending products to attract new set of customers plus diversifying credit portfolio minimising risks. I think it is important for Financial institutions to start considering investment on Fintec technology to use for MFI which will minimise a lot of costs to borrowers and increase their productivity. The level of Financial Awareness (Financial literacy) must match the level of Lending business volumes, especially for Pacific market to be successful!

Microfinance is the right choice, it helps poor people who are in need. Unlike other banks in Papua new Guinea they say the provide service but as for me they don’t, they only want to make money, that is why the rich are still rich and the poor are still poor. I would like the microfinance management to operate in an honest way in order to change life. I am struggling too, I want a good future for my children and us as clients we must be honest especially in borrowing, please do not be selfish because it will affect everyone.

It seems to me – 30% loans each fortnight….to those improvised keeps them deep in a poverty trap. This appears normal practice in urban PNG. What is the consensus around this practice?.

I believe that this research only points to one side of the coin. It presents the lender’s point of view and lacks the borrower’s point of view. It is estimated that 15% of the 7.7 million population are currently in the workforce and living in towns and cities. This means that approximately 85% of people live in the rural areas. In my research titled “Alleviating poverty through micro credit: Papua New Guinea Case study”. I focus my research on the borrower’s perspective, I found out that there are two very important problems that the borrowers face. The first one is accessibility – micro finance institutions are based in certain commercial centers. E.g. PNG microfinance in Mt. Hagen is serving almost all of the population of half a million people in WHP and JIWAKA. Just imagine less than 10 bank officers serving 85% of almost 500,000 people of Jiwaka and Mt. Hagen. A customer said she has to wait for hours just to find out that she does not have the historical cash flow or/and cash collateral to obtain the loan. So left and never went back again. She also discourages other people to seek loans with these finance companies. The other customer said “He travels for hours to come to the bank to find out that he had to wait again for some hours to get served. If he had to wait then he will miss the only PMV back to his village so he didn’t want to try. The first problem is accessibility. Banks focus so much on risks and overhead costs that they discourage people from accessing their credit facilities. The other problem is loan requirements. I interviewed a mother in Madang and she said, “In order for me to get a K15000 loan from Peoples Microbank, I had to offer my husbands van as a collateral and at the same time write a business plan including projected cash flow, income statement and Balance sheet. Just image a Gr. 10 leaver being asked to provide all these. As an Accountant and MBA I couldn’t understand too. She didn’t went back to Peoples Microbank again. She even discourages others from going there too. It is all about convenience, not about risk or demand. See how BSP is successful. The electronic channel is their green gold. They have more than 200 ATMs and 12000 Eftpos all over PNG. Even though they charge a lot of fees, people still go for it. It all about convenience. People will pay any cost to consume it. The other example in Digicel; they have towers all over PNG. Even though some customers complain about voice calls fees or their credit disappearing, they still use Digicel because its accessible almost everywhere. Hence, those who want to do further research please see also the customers point of view.

Excellent comments and anecdotes, Sam. Cheers Rob Hickson

I think this research you’ve carried out supports the fact that the country’s MFI’s and Banks are experiencing low LTD due to factors such as accessibility and imposing of huge collateral requirements on borrowers. Hence, the MFI’s inflict the issue of low LTD upon themselves.

Therefore, they should take the initiative of addressing it first hand before seeking government intervention.

Micro credit is dependent on both demand and supply factors. Ghandi Katoa highlighted a number of supply (and institutional)factors. I offer a demand side view that microloans cannot be raised unless there is a bankable proposal – the generation of business ideas. PICs are mostly followers, imitators and copycats. There is a need for a ‘Bank of Ideas’ – some of these are kept in archives of research institutions and or Universities. This crosses the field of small business development- a component badly missing from financial inclusion or micro finance programs. Currently, there is too much focus on savings and very little on the generation of income either through paid employment or small business creation. Bankers should also start learning business creation apart from learning bank or lending policies.

There are two issues that, although outside the discussion, give rise to low borrowing levels. The first is stringent rules for eligibility to borrow. Although not as stringent as commercial banks, they are still restrictive enough that 90% of people who save with those MFIs cannot meet the criteria. The second is interest rates. A micro loan is for a small emterpreneur making small profits yet the interest rates are comparable to commercial banks. No one wants to borrow.

I do agree with this article, the demand for microcredit in PNG is low relative to the neighboring pacific and Asian neighboring countries. From my view as a practitioner in the industry over the last 10 years, the rationale for low demand for credit from licensed microfinance institutions(MFI) can fall into these four categories;

1. Lending Culture of Microfinance institutions(microbans & sls): The lending culture in these two types of institution (microbanks & SLS) varies on three aspects but not limited. These include; the regulatory requirements, capacity, and the management of this institutions. SLS lending is strictly regulated by the Central Bank of PNG while microbanks are not. In a strictly regulated environment “you only do as told” and institutions cannot expand their lending portfolio or improve their investments. SLS and microbanks still lack the technical capacity, though there were intervention by donor agencies in funding technical support for this institutions. The management of these institutions are critical to their success and growth. Many of these institutions have portfolio at risk sitting at above 10% and some 20%. The smaller ones even have greater PAR. Because of their lack of doing proper credit assessments and reviewing of their credit products/policies based on market demand, resulting in many bad loans, they are becoming risk averse in their lending. Their credit risk interventions measures are having an adverse effect on the customer apatite to borrow.

2. Pricing of lending products: Unlike the microbanks, who set their own pricing, savings & loans societies lending products interest rates and loan rations are regulated by Central Bank of PNG. All interest on loans are 12% per annum and loan ratio of 1:1 (100% savings collateralized loans). Any increment in the loan ratio to collaterals are to be approved by the regulator. Customer are not able to borrow more than what they have in savings. At some instance SLSs have requested BPNG for increment on loan ratio for consumer lending including school fees etc… SME lending by SLS is to a certain extent considered may lead to harming their portfolio due to lack of capacity in doing SME lending. On the other hand the microbanks lending products have high interest rates and stringent collateral requirments. Microbanks are doing 100% secured lending meaning collaterals both cash and non-cash must fully cover the loans. Non-cash collaterals ranging from white and brown goods to titles deeds. Cash collateral ratios are 20% -50% depending risk perceived by the bank. Microcredit consumers are mostly from the informal economy and thus lending products and policies of microbanks are not reflective of the type of client they serve.

3. Consumer Behavior – Consumer behavior not studied may lead to institutions not designing/refining their credit product/policies to meet the market demand. From general observation customer are willing to pay for the lending service so long as their needs are met and they are able to repay. But when microfinance institutions are not responding to consumer demand and fine tune or review their lending products or policies it affects the demand for credit.

4. Macro Economic Landscape – The macroeconomic landscape of the country must be considered when assessing the demand for credit. From current observations, demand for credit is reducing due to the government cash flow situation and business climate. SME relying on government contracts are having difficult time repaying their debts with financial institutions. The operating cost is ever increasing and with a depreciating Kina, lending risk are being tighten, thus having adverse effect on credit demand.

Whether it be for financing consumer needs or medical needs or school fee needs or micro-SME business needs, the need for micro credit is increasing. It is now up to the Policy makers and the players to ensure that microcredit market is demand driven and not MFI driven.

Thank you, Ghandi Katao, for these four categories of rationale for low demand for credit from licensed MFI’s.

Well researched document. I agree since I worked with a Savings and Loan Society